Construction

Image from National Museum of Australia

Image from http://www.droneace.com.au/construction-site-drone-video-intrec-concrete-slab-pour/intrec-augusta-state-school-concrete-slab-pour-_20-2/

Key theme of site:

- Focus on construction and infrastructure to raise productivity, generate jobs and deliver return on investment

Because construction projects create long-term return on investment and widespread benefits, this site advocates spending on infrastructure, urban and regional development as a core element of economic stimulus in response to the Covid 19 pandemic.

George Megalogenis in his 2016 Quarterly Essay ‘Balancing Act’ makes a good case for the importance of the construction industry for male employment, with important consequences for political stability.

Books like Andrew Leigh’s Battlers and Billionaires and Jennifer Rayner’s Blue Collar Frayed also highlight the importance of employment opportunities for skilled workers.

The construction industry obviously underpins building infrastructure, as well as urban and regional development.

The site advocates using the best possible integrated planning, engineering and design to achieve optimum outcomes for sustainable development and quality of life through the construction industry.

This includes energy efficiency, and environmental sustainability as a core element of infrastructure, urban and regional development. Examples of this approach would be investing in public transport, infrastructure for electric vehicles, and building integrated solar PV materials. The materials on this page indicate Australia has strong capacity and existing planning frameworks to achieve these objectives.

This sector depends on a well resourced vocational training system, as well as excellent engineering, architectural, planning and design graduates.

As Infrastructure Australia’s 2019 national infrastructure audit (see below) indicates, Australia faces major infrastructure challenges. These can also be seen as opportunities for economic modernisation and development.

https://australianjobs.employment.gov.au/jobs-industry/construction

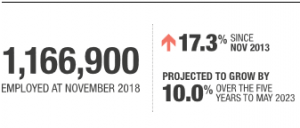

Construction is a large employing industry and a significant number of new jobs have been added in recent years. This growth, however, has slowed recently and employment has fallen slightly in the past year. Technicians and Trades Workers account for 51% of workers and most jobs are full-time (85%).

Training is generally through the vocational education and training sector. More than half of those employed hold a certificate III or higher vocational qualification, often gained through the completion of an apprenticeship. There were 86,700 apprentices and trainees employed in this industry in 2018.

One third of workers in this industry do not hold post-school qualifications and around 16% are Labourers, suggesting there are also some good entry level opportunities.

Construction is projected to have above average employment growth over the five years to May 2023. Strong growth is expected across all sectors of this industry.

Construction_industry_profile_and_Outlook

Australian Industry Group ‘Australia’s Construction Industry: Profile and Outlook, July 2015′

Provides a comprehensive overview of the construction industry

Infrastructure

Some Infrastructure Australia links and the following article ‘In light of the disruptive environment that currently prevails in Australia’s infrastructure sector, management consultancy McKinsey & Company has put forth six recommendations on how the sector can navigate change and improve its track record of delivery.’

current_priority_list_ february_2020

Infrastructure Australia’s 2020 Priority List of projects to build.

Australian Infrastructure Audit 2019 – Executive Summary Brochure

Infrastructure Australia: An Assessment of Australia’s Future Infrastructure Needs The Australian Infrastructure Audit 2019, Executive Summary

Excerpts from ‘Overview’

Fast-growing cities: Infrastructure in our four largest cities is failing to keep pace with rapid population

growth, particularly on the urban fringe.

Smaller cities and regional centres: These areas are growing as service hubs for their neighbouring

regions, including supporting growth as satellites of fast-growing cities.

Towns, rural communities and remote areas: The quality of infrastructure services for people living

in remote communities does not meet the standards Australians expect.

Developing regions and northern Australia: Infrastructure can catalyse quality of life and productivity by improving connectivity and efficiency.

Excerpts from Key Messages

- Since the last Audit, governments and industry have made important progress to promote reform, improve planning and invest in infrastructure gaps. Since 2015 over $123 billion of work has commenced, with a committed forward pipeline of over $200 billion.

- However, changing and growing demand, and a mounting maintenance backlog, mean a new wave of reform and investment is necessary to ensure quality of life and economic productivity are enhanced over the next 15 years. By 2034, Australia’s population is projected to grow by 23.7% to reach 31.4 million, adding to infrastructuredemand, while existing infrastructure struggles under maintenance backlogs and the condition of many assets is unknown.

- Growing social, economic and environmental interdependencies have added both complexity and opportunity to the planning, delivery and operation of our infrastructure. For example, the increased uptake of electric vehicles will have implications for the energy sector. By 2040 40% of our vehicles are likely to be electric, and these vehicles could have the potential to store electricity to a similar capacity as the proposed Snowy 2.0 scheme.

- In 2017-18 economic activity in Sydney and Melbourne together accounted for 52.8% of national growth. To support this activity the New South Wales and Victorian governments have a committed forward pipeline of transport infrastructure investment totalling over $78 billion in these cities.

- Population growth impacts are being felt in fast growing cities as infrastructure is placed under pressure, including congestion on our roads and crowding on public transport. 77% of population growth over the coming 15 years is projected to occur in our fast-growing cities,12 leading to pressure including road congestion growing by $18.9 billion to $38.8 billion in 2031.

Image from https://www.wattelectricalnews.com/NEWS/Australia-Construction-in-Expansion-for-5th-Month/21967

Australian-Infrastructure-Investment-Report-2019

Infrastructure Partnerships Australia: Australian Infrastructure Investment Report 2019.

‘Infrastructure Partnerships Australia is an industry think tank and an executive member network, providing research focused on excellence in social and economic infrastructure.’

The report relates to a survey of Australian and international infrastructure investors. It indicates continuing strong interest in infrastructure investment in Australia based on a strong track record of delivery, with emerging concerns about capacity constraints and some planning/regulatory uncertainty.

Excerpt from Executive Message

However, Australia is somewhat a victim of its own success, with the sector feeling the pressure of a high

volume of projects simultaneously entering the delivery phase. This increased market pressure is seeing risk

allocation on complex projects, and capacity constraints in the construction market, begin to impact the cost of infrastructure delivery. Ninety per cent of participants agreed that the Australian infrastructure market is facing

capacity constraints, with these constraints felt to a high degree in civil and tunnelling projects. While challenging,

many of these risks can be traced to a flourishing market and are typically priced to match risk and reward.

Investment-Opportunities-in-Australian-Infrastructure-brochure

Austrade report/brochure designed to attract foreign investment in Australian infrastructure. Attractively presented information about the sector and many high profile projects.

https://www.wattelectricalnews.com/NEWS/Australia-Construction-in-Expansion-for-5th-Month/21967

Regional Development

RegionsattheReadyInvestinginAustralia’sFuture.pdf;fileType=application_pdf

Regions at the Ready: Investing in Australia’s Future report of House of Representatives Select Committee on Regional Development and Decentralisation, 2018

Excerpts from Chair’s Foreword, Damian Drum MP

As Australia battles to deal with its centralised population and the congestion caused by having over 40 per cent of its population living in its two biggest cities, the realisation is stark; we have to take a different approach to growing our regions if we want to achieve a different outcome.

For many decades now, Melbourne and Sydney have dominated Australia’s population. As these cities and our other capitals have grown and prospered, the demand for further infrastructure investment continues to grow. These endless demands from our capital cities for more lanes on the freeways, more trains running more often, bigger hospitals, universities and airports etc. puts the nation into a continuous need for more resources.

Once these infrastructure projects are completed, these capital cities continue to thrive and become more liveable, and then more and more people make the decision to live in these capitals and the congestion cycle starts all over again.

Until we have a fundamental shift in spending priorities away from our congested capital cities and share the infrastructure spending with regional Australia, we cannot expect the current imbalance to correct itself.

As a result of this cycle, more and more Australians are growing tired of congestion in our capital cities, despairing at the inability to enter the housing market and generally struggling to get ahead while living in these growing suburban based cities.

The regions of Australia have never been in a better position to take advantage of an Australian population that is looking away from our capital cities, looking to the regions for a better all-round life. Regional Australia is ready to welcome these people with open arms. To live five to ten minutes from work, to own your own home, to have space for children to grow and play, these are the benefits our regions have over our capitals. We just need a greater share of the funding pie invested in regional Australia.

While the quantum of spending in regional Australia is a critical factor, it is also important that our funding be more targeted. The Committee continually heard that the most important issues are around making our regional cities, towns and communities more connected. Connectivity can be described as having better roads, better rail services, mobile phone coverage and access to quality broadband internet. Especially important is that those living in regional Australia have access to a reasonable base level of services such as health and education.

The final piece of the puzzle that influences people’s decision to live in the regions is that of amenity. The amenity of a city, town or community can be in the visual aesthetics, the buildings, the parks, theatres, the access to shops, recreational facilities etc. While amenity is a broad and wide reaching category, if we fail to invest in amenity, we will also fail to entice people to live in regional Australia.

It must also be noted that while government agencies being relocated from capital cities out to regional cities become the face of decentralisation policy it is, however, the private sector that has the ability to dwarf the benefits that will be delivered from relocating government sector positions.

Private sector decentralisation is often dependent on the decisions of government that set the environment for private sector movements.

It is also abundantly evident that we need to categorise our investment in regional Australia into four discernible categories. First, there is what we would all acknowledge as investments that maintain the status quo; these projects are necessary as they assist in enabling regional towns and cities to provide that universal base level of service and amenity.

Second, and perhaps more importantly, is catalytic investment. These investments attract further investments and they help create and build on a critical mass in a particular sector. These catalytic investments which lure other businesses into a co-location should be given greater priority within government decision making.

Third, is investment in capacity building of our rural communities particularly education and training and leadership development.

And finally, there is investment in human capital. This includes the employment of people to design and deliver services in rural communities. It is this investment that provides the greatest opportunity for government decentralisation policy.

The role of identifying the catalytic type investments is one that would be well served by our Regional Development Australia Committees into the future.

Recommendations excerpts

9.14 The Committee’s strategy for developing and sustaining regional Australia consists of six elements:

1 build the enabling infrastructure for regional development;

2 identify national regional development priorities;

3 establish a Regional City Deals program;

4 strengthen the RDA network;

5 establish a public sector decentralisation policy; and

6 strengthen the role of regional universities.

9.23 Establishing a list of national regional development priorities would provide certainty for rural and regional Australia. This certainty would allow private companies to make the best decisions on how and when to invest in regional Australia.

9.24 It would also increase the potential for catalytic investment within rural and regional areas. This occurs when knowledge of development priorities attracts investment, associated business, and further infrastructure development. This in turn improves the social and economic prosperity of regional communities, and creates more opportunities for growth.

Development of regional strategic plans are also recommended to attract catalytic investment. Such plans would form the basis for Regional City Deals. Regional City Deals, like existing City Deals, would be negotiated between all levels of government, the private sector and community groups to deliver investment appropriate for specific regional cities. The committee found that they were consistently requested in the consultation process.

Rural and Regional Development Position Statement

Planning Institute of Australia Position Statement

OECD document containing a short summary of Australia’s regional development policy

Contains ‘About Us’ page of Regional Development Australia, and Federal Government’s response to Regions at the Ready report

Urban Development

While the Commonwealth government has periodically produced some plans and policy documents on cities, more detailed and specific planning documents backed by funding commitment and a history of delivery have been produced by State governments. This reflects the division of roles between sate and federal governments, and the intimate connection between cities and states.

A selection of articles and links on Sydney and Perth urban and transport planning

Plan_Melbourne_2017-2050_Summary

The_30-Year_Plan_for_Greater_Adelaide

This document contains a brief summary of CSIRO research projects relating to future cities.